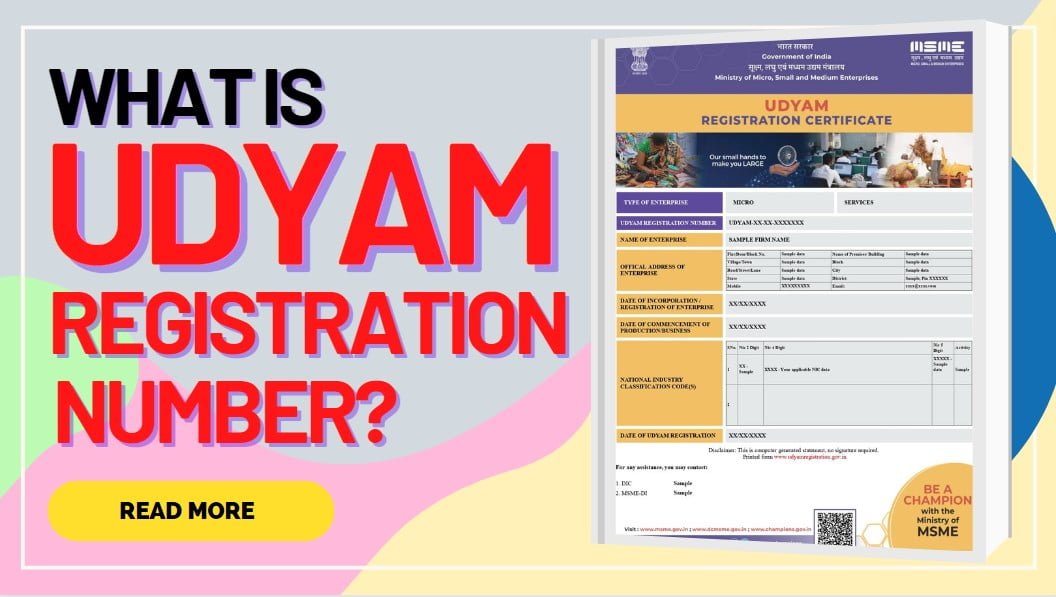

Udyam registration number is a unique 19-digit serial number of the udyam certificate of a particular registered business on the MSME portal.

The format of the udyam registration number is UDYAM-AP-00-0123456. The registration number can be used to check the status of your udyam registration, edit, or download and print the udyam certificate online.

Udyam Registration Number Format

The Udyam registration number format can be further clarified.

The format of the Udyam registration number can be explained further.

1. First 5 Letters – UDYAM

2. Next 2 Digits – STATE CODE

3. Next 2 Digits – CITY CODE

4. Next 7 Digits – Are special Udyam Code assigned to a company, similar to an Aadhar number.

How can I get 19 digit Udyam registration number?

You can get the udyam registration number by applying for it on the udyam registration portal. Getting your Udyam registration certificate with a 19-digit udyam number is fast and easy, and you can do it from the comfort of your office at any time. Simply follow these 6 simple steps to request your udyam registration number online.

Step 1: Using a laptop or phone go to the website for the udyam registration portal.

Step 2: Click the button under the Udyam Registration Certificate tab.

Step 3: Complete the udyam registration form with your name, Aaadhar number, mobile phone number, and e-mail address amongst other information to request your certificates.

Step 4: Also, select the registered e-mail address and mobile phone number where you want to get your OTP (unique password). The single-use password will be sent to your registered email address or mobile number.

Step 5: Your request will be reviewed by Udyam representatives, who will then verify if your udyam request must be approved.

Step 6: Once verified, your registered udyam certificate will be sent to your registered email address.

Note: Once the OTP is sent to you, you must share it with udyam representatives in order to proceed with the online verification process.

What are the documents required for getting the udyam registration number?

Before requesting the udyam registration number you should organize some documents, listed below.

- Aadhar card number

- Full Name as on Aadhar card

- PAN number

- Bank Account details

- Phone number

- Email Id

Note: Your mobile number should be integrated with your Aadhar card.

These are the important documents required for registering under the MSME registration portal and getting a unique udyam registration number for your business.

If You Are Still Not Registered For Udyam, You Can Fill Out this Udyam Application Here.

What are the Benefits of Udyam Registration Certificate?

The following are a few benefits of Udyam Registration.

- Simple Bank Loan up to Rs 1,000,000 without Collateral or a Mortgage

- Special Preference in Government Tender Procurement

- Exemption from interest on bank overdrafts of 1% (OD)

- Reduction in electricity costs

- Protection against Buyers’ payment delays

In order to avail of these benefits for central and state government then apply for udyam certificate online now. After online registration, your company will qualify as an MSME and be eligible for additional government schemes & programmes, services, tenders, benefits, and subsidies after you get your business udyam registration certificate.

Do not hesitate to contact our staff at Udyam Helpline if you need more information about MSME, Udyog Aadhar, or Udyam Registration Certificate.

Check out Udyam’s frequently asked questions and answers.

What are the costs for registering for Udyam online?

You will be charged Rs 1499 for Udyam Registration with Udyam Experts.

What kinds of documentation are needed for online Udyam registration?

The updated MSME udyam registration process is entirely electronic, paperless, and self-declaratory. There are no files or documentation that must be uploaded in order to register an MSME. While filling out the udyam application form, you could still require your Aadhaar card, Pan card, and bank account information.

Is Udyam Registration Mandatory?

Yes, registration for the Udyam certificate is mandatory in India.

Is GST compulsory for Udyam registration?

No, GST is not compulsory for udyam registration.

Are you a business owner who is ready to apply for udyam certificate, then you might be looking for the udyam registration number?

Read these Udyam Blogs:

New MSME Classification – Micro Small Medium Enterprises

Difference Between Udyog Aadhaar And Udyam

Udyam Registration Benefits in Hindi

25 MSME Udyam Registration Benefits

Online Udyam Registration Portal

Benefits of new Income Tax e-filing Portal in Hindi – नई आयकर इ-फ़ाईलिंग पोर्टल के फायदे ।

Difference between old and new Income Tax e-filing Portal in Hindi

New Income Tax e-filing Portal नई आयकर इ-फ़ाईलिंग पोर्टल हिन्दी में ।

Is Udyam Registration Mandatory?

Udyam Registration Benefits in Hindi -उद्यम रेजिस्ट्रैशन सर्टिफिकेट के फायदे

Udyam registration certificate kya hai – उद्यम रजिस्ट्रेशन सर्टिफिकेट क्या है