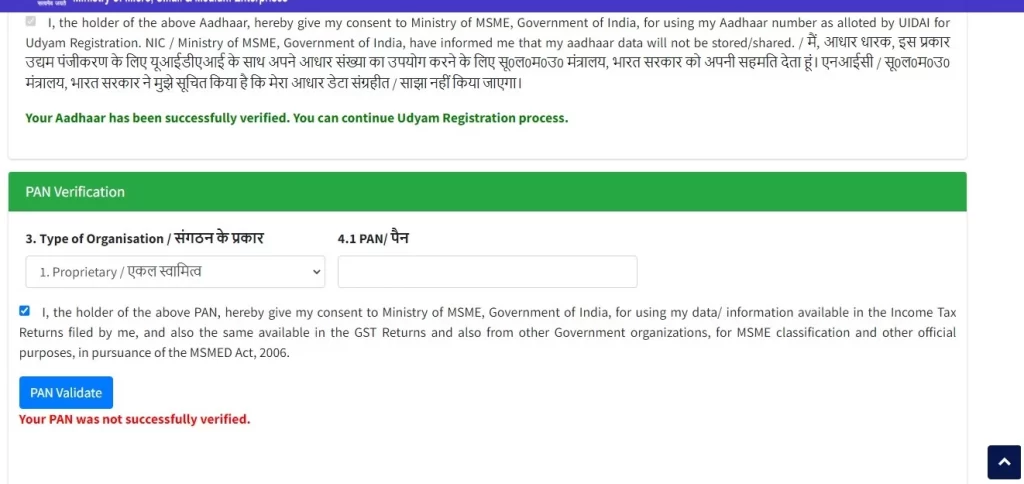

You might be facing an error on udyam registration portal and you are unable to verify pan number for udyam registration certificate process.

Are you getting this error on the official website of udyam registration portal – Your pan was not successfully verified. Do not worry as we can help you in getting the udyam registration pan verification process by following the below steps.

Do you want to know How to check if a pan card is valid or not for processing udyam registration for your business?

Are you facing issues with the verification of your PAN number for the Udyam registration certificate process?

Read this comprehensive guide to understand the steps, FAQs, and solutions related to the “unable to verify PAN number for Udyam registration certificate process” and ensure a smooth registration experience.

Obtaining a Udyam registration certificate is a crucial step for small and medium-sized enterprises (SMEs) in India. It provides various benefits and opportunities for businesses.

However, sometimes the process can be challenging, particularly when encountering issues with verifying the PAN number.

In this guide, we will explore the common problems faced during the verification of PAN number for the Udyam registration certificate process and provide solutions to help you overcome them.

Unable to Verify PAN Number for Udyam Registration Certificate Process

What is the Udyam Registration Certificate Process?

Before diving into the specifics of PAN number verification, let’s briefly understand the Udyam registration certificate process. Udyam is an online registration portal introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME) in India. It aims to provide a single-window system for registration and recognition of MSMEs.

The registration certificate serves as proof of the business’s existence and enables access to various government schemes, subsidies, and benefits.

Importance of PAN Number Verification

During the Udyam registration certificate process, verifying the PAN number is a crucial step. The PAN (Permanent Account Number) serves as a unique identification number for taxpayers in India.

Verifying the PAN number ensures the authenticity of the business entity and helps the government in maintaining accurate records.

However, due to technical glitches or errors, individuals may encounter difficulties in completing the PAN number verification.

How to Verify Pan card for Udyam registration?

STEP 1: Visit the Udyam Registration Portal

STEP 2: Fill out the application form to verify your pan card number for the udyam process.

STEP 3: Make the online payment for the MSME udyam aadhar pan verification

STEP 4: One of the executive will verify your pan for udyam registration process

STEP 5: Within 15 mins you will get email notification of successful pan verification for udyam registration.

Note: During the process you have to share the otp with our executive for MSME pan verification for udyam registration.

Benefits of PAN Number Verification

Verifying your PAN (Permanent Account Number) during various processes and transactions in India offers numerous benefits. PAN number verification serves as a crucial step to ensure the authenticity and accuracy of the information provided.

Let’s explore the significant advantages of PAN number verification:

1. Financial Transactions:

PAN number verification is essential for various financial transactions, such as opening a bank account, applying for loans, or investing in the stock market. Financial institutions and regulatory authorities require PAN verification to prevent fraudulent activities and ensure the legitimacy of the transactions.

2. Income Tax Filing:

One of the primary purposes of PAN number verification is for income tax filing. Individuals and entities with a PAN number can accurately report their income and pay taxes. PAN number verification helps in tracking financial activities, maintaining tax compliance, and reducing tax evasion.

3. Government Services and Subsidies:

Verifying your PAN number is crucial to avail government services, benefits, and subsidies. PAN number verification ensures that individuals or businesses meet the eligibility criteria for various government schemes, such as subsidies on LPG cylinders, scholarships, pensions, or agricultural support programs.

4. Identification and Address Proof:

A verified PAN number serves as a valid identification proof accepted by various authorities. It helps in establishing the identity and address of individuals or entities during official documentation, such as applying for a passport, obtaining a driver’s license, or purchasing property.

5. International Transactions:

PAN number verification is often required for international transactions, such as foreign investments, remittances, or international money transfers. It helps in complying with international tax regulations and preventing money laundering or illegal fund transfers.

6. KYC Compliance:

PAN number verification is a crucial component of the Know Your Customer (KYC) process mandated by financial institutions and service providers. By verifying the PAN number, businesses can ensure the authenticity of their customers and comply with legal and regulatory requirements.

7. Business and Legal Transactions:

For businesses, PAN number verification is vital for legal and financial transactions, including registering a company, filing GST returns, participating in government tenders, or conducting business with other entities. A verified PAN number establishes credibility and trustworthiness in business dealings.

8. Avoiding Penalties and Legal Consequences:

Failure to verify the PAN number or providing incorrect PAN details can lead to penalties, fines, or legal consequences. PAN number verification helps in avoiding such issues by ensuring accurate identification and compliance with tax and financial regulations.

9. Establishing Creditworthiness:

Verifying your PAN number is crucial for building and establishing creditworthiness. Financial institutions and credit rating agencies use PAN information to assess an individual or business’s creditworthiness while extending credit facilities or evaluating loan applications.

10. Secure and Transparent Transactions:

PAN number verification enhances the security and transparency of financial transactions. By linking transactions to verified PAN numbers, it becomes easier to track and monitor financial activities, ensuring a secure and accountable financial system.

In conclusion, PAN number verification offers a wide range of benefits, including facilitating financial transactions, ensuring tax compliance, accessing government services and subsidies, establishing identity and address proof, and enabling secure and transparent transactions.

Verifying your PAN number is essential for individuals and businesses to comply with legal and regulatory requirements while enjoying the advantages and opportunities provided by the Indian financial system.

Documents Required for PAN Verification for Udyam Registration

When verifying your PAN (Permanent Account Number) for Udyam registration, certain documents are typically required to ensure the accuracy and legitimacy of the process.

These documents help establish the connection between the PAN number and the business entity. Here are the essential documents you may need for PAN verification during Udyam registration:

1. PAN Card:

The primary document needed for PAN verification is the PAN card itself. Ensure that you have a valid PAN card issued by the Income Tax Department of India. The PAN card should be in the name of the business entity or the proprietor/partner/director, depending on the type of organization.

2. Aadhaar Card:

Along with the PAN card, you may need to provide a copy of the Aadhaar card as an additional identification document. The Aadhaar card serves as a unique identification proof for individuals and can further establish the authenticity of the PAN details.

3. Business Registration Certificate:

Depending on the type of business entity, you may be required to submit the business registration certificate. This could include documents such as the Certificate of Incorporation, Partnership Deed, or Memorandum of Association, among others. These documents help establish the legal existence of the business entity.

4. Address Proof:

To verify the PAN number, you will need to provide address proof documents. These documents should reflect the address mentioned in the PAN card. Acceptable address proof documents may include a recent utility bill (electricity bill, water bill, etc.), bank statement, or rent agreement.

5. Identity Proof:

Along with address proof, you will also need to submit identity proof documents. These documents should establish the identity of the individual or authorized person associated with the PAN number. Commonly accepted identity proof documents include a valid passport, voter ID card, or driving license.

6. Business Bank Account Details:

It is advisable to provide the bank account details of the business entity during PAN verification. This helps establish the financial connection between the PAN number and the business operations.

7. Authorized Signatory Documents:

If the PAN number verification is being done on behalf of the business entity by an authorized signatory, you may need to provide documents to establish the authority of the signatory. This could include a Power of Attorney (POA) or a Board Resolution, depending on the organizational structure.

8. Additional Business-specific Documents:

Depending on the nature of the business, additional documents may be required. For example, for a manufacturing unit, you may need to provide details such as the factory license, environmental clearances, or GST registration certificate.

When verifying your PAN (Permanent Account Number) for Udyam registration, along with the necessary identification and business documents, you will also need to provide your mobile number and email address. These contact details play a crucial role in the verification process and ensure effective communication between the registration authorities and the business entity. Here’s why mobile number and email address are required:

9. Mobile Number:

Providing a valid mobile number is essential for PAN verification during Udyam registration. The registered mobile number allows for easy communication with the business entity regarding the verification process, updates, and any additional information required. It serves as a primary contact point and enables timely notifications and alerts.

9. Email Address:

Similarly, a valid email address is required for PAN verification. The registered email address allows for official communication, exchange of documents, and notifications related to the Udyam registration process. It ensures that important information is received and facilitates smooth correspondence with the registration authorities.

By providing an accurate and functional mobile number and email address, you ensure that you receive important updates, notifications, and any requests for additional information or clarification during the PAN verification process. It is crucial to provide contact details that are actively monitored to ensure a seamless and efficient verification experience.

During the Udyam registration process, you will be prompted to provide your mobile number and email address as part of the contact information section. Make sure to double-check the accuracy of these details to avoid any communication-related issues. Additionally, ensure that the mobile number is in active use and the email address is regularly checked for messages from the registration authorities.

Remember, providing correct and up-to-date contact details, including the mobile number and email address, is vital to complete the PAN verification successfully and to receive important updates and communications related to your Udyam registration certificate.

Please note that the specific requirements and guidelines for providing mobile number and email address may be subject to change or further clarification by the Udyam registration authorities. For the most up-to-date information on the required documents and contacts for PAN verification during the Udyam registration procedure, it is advised to consult the official Udyam registration portal or get advice from the necessary authorities.

It is important to note that the specific documents required for PAN verification during Udyam registration may vary based on the business type, organizational structure, and other factors. It is recommended to consult the Udyam registration portal or seek consultation from the authorities for a comprehensive list of required documents for msme registration.

Ensure that all the provided documents are accurate, up-to-date, and in compliance with the guidelines provided by the Udyam registration authorities.

FAQs:

1. Why am I unable to verify my PAN number for the Udyam registration certificate process?

If you are facing issues with PAN number verification, it could be due to various reasons. Some common causes include:

- Inaccurate data entry of PAN number

- Technical glitches in the Udyam registration portal

- Mismatch between PAN details and business entity information

- Invalid or expired PAN number

2. What should I do if my PAN number is not getting verified?

If you are unable to verify your PAN number during the Udyam registration certificate process, here are some steps you can take:

- Double-check the PAN number entered for accuracy

- Ensure that the PAN details match the information provided for the business entity

- Contact the Udyam registration helpline or customer support for assistance

- Verify the validity of your PAN number and update it if necessary

3. Can I use someone else’s PAN number for Udyam registration?

No, it is not permissible to use someone else’s PAN number for Udyam registration. Each business entity should have its unique PAN number, associated with the correct taxpayer. Using someone else’s PAN number can lead to legal complications and potential penalties.

4. How long does it take to resolve PAN number verification issues?

The time required to resolve PAN number verification issues can vary depending on the specific problem. In some cases, it may be resolved within a few days, while in others, it might take longer. It is recommended to follow up with the Udyam registration authorities or seek assistance from customer support for timely resolution.

5. Can I proceed with Udyam registration without verifying my PAN number?

No, it is essential to verify your PAN number for successful Udyam registration. Without the PAN number verification, your registration process may remain incomplete, and you may not be able to avail the benefits and opportunities associated with the Udyam registration certificate.

6. Are there any alternative methods for PAN number verification?

In certain cases, if you are facing persistent issues with PAN number verification, you may explore alternative methods. Contacting the Udyam registration authorities or visiting the nearest MSME office can provide guidance on alternative ways to verify your PAN number and complete the registration process.

7. Can Udyam registration be done without PAN?

No, udyam registration cannot be done without PAN number.

Conclusion:

Obtaining a Udyam registration certificate is a vital step for MSMEs in India, and verifying the PAN number is an integral part of this process. Facing difficulties during the PAN number verification can be frustrating, but it is important to remain patient and follow the necessary steps to resolve the issues.

Double-checking the PAN number, ensuring accurate information, and seeking assistance from the Udyam registration helpline or customer support are crucial in overcoming verification hurdles. Remember, a verified PAN number not only ensures a smooth registration process but also opens up avenues for accessing government schemes and benefits.

Follow us on Google News