With frequent regulatory changes in India’s MSME framework, many businesses still ask an important compliance question in 2026:

If a unit is registered under Udyog Aadhaar but has not migrated to the Udyam Portal, can it still be treated as an MSME?

The short and clear answer is No.

A unit with an unmigrated Udyog Aadhaar registration is no longer recognized as a valid MSME in 2026.

This blog explains the official status, current requirements, and practical implications of not migrating from Udyog Aadhaar to Udyam Registration.

Migrate Udyog Aadhar to Udyam Now

Fill out the Udyam Registration Application for Milk Farming Business in India

Understanding Udyog Aadhaar and Udyam Registration

What Was Udyog Aadhaar?

Udyog Aadhaar Memorandum (UAM) was an earlier MSME registration system introduced to simplify business registration. It allowed enterprises to self-declare their MSME status with minimal documentation.

Why Was It Replaced?

To improve data accuracy, transparency, and integration with tax systems, the Government of India introduced Udyam Registration in July 2020, replacing Udyog Aadhaar entirely.

Official Status of Udyog Aadhaar in 2026

Udyog Aadhaar Memorandum (UAM) is no longer valid in 2026.

UAM was officially replaced by Udyam Registration in July 2020

The government provided multiple migration extensions

The final migration deadline was June 30, 2022

After this date:

✅ Only Udyam Registration is legally recognized

❌ Unmigrated Udyog Aadhaar registrations ceased to be valid

This means that any unit still relying solely on Udyog Aadhaar cannot claim MSME status in 2026.

Current MSME Registration Requirements in 2026

To be treated as an MSME today, a business must:

Be registered on the official Udyam Portal

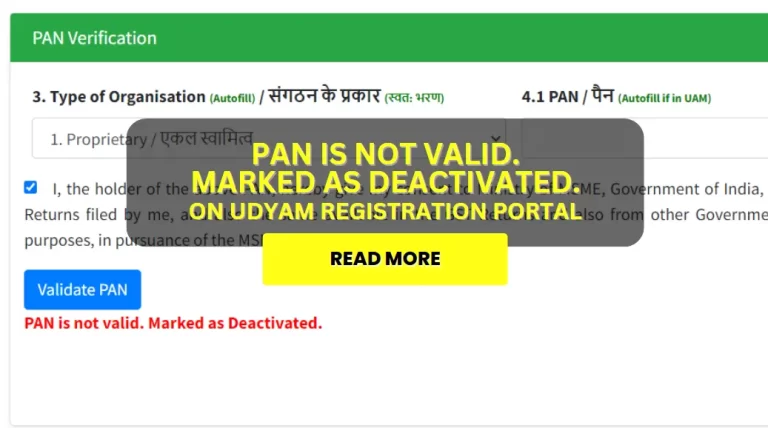

Use Aadhaar-based authentication

Have PAN-linked financial data

Meet MSME classification criteria based on investment and turnover

Key Features of Udyam Registration

Fully online and government-managed

Aadhaar + PAN based verification

Lifetime validity

Auto-linked with GST and Income Tax systems

👉 Udyam Registration is now the sole valid MSME identification system in India.

What Happens If Udyog Aadhaar Is Not Migrated?

Loss of MSME Recognition

If a unit has not migrated to Udyam:

It is treated as a non-MSME unit

Udyog Aadhaar number has no legal standing

Ineligibility for Government Benefits

Non-migrated units lose access to key MSME schemes, including:

Mudra Loans

CGTMSE credit guarantee

Priority sector lending

Government tenders

Subsidies and incentives

MSME-specific exemptions and protections

Compliance & Audit Risk

Banks, auditors, government departments, and PSUs only recognize Udyam certificates.

Presenting Udyog Aadhaar alone may lead to:

Loan rejections

Tender disqualification

Adverse audit remarks

Is There Any Alternative to Udyam Registration?

No.

The Government of India has clearly stated:

Udyam Portal is the only authorized MSME registration system

No private portals or third-party registrations are valid

Any MSME benefits claimed without Udyam registration are not legally enforceable

How to Regain MSME Status in 2026

Businesses with old Udyog Aadhaar numbers must:

Visit the official Udyam Registration portal

Use their UAM number for migration

Authenticate via Aadhaar and PAN

Complete registration to obtain a Udyam Certificate

Once registered, MSME status is restored with lifetime validity, subject to eligibility criteria.

Final Conclusion

In 2026, a unit with an unmigrated Udyog Aadhaar registration is not considered an MSME.

Only businesses registered under Udyam Registration are:

Officially recognized as MSMEs

Eligible for government schemes

Accepted by banks, PSUs, and authorities

👉 Until migration is completed, such units must be treated as non-MSME units.

Frequently Asked Questions (FAQs)

Is Udyog Aadhaar still valid in 2026?

No, Udyog Aadhaar is not valid in 2026. It was replaced by Udyam Registration in July 2020. Businesses that did not migrate their Udyog Aadhaar to the Udyam Portal by the final deadline are no longer recognized as MSMEs.

Can a business be treated as MSME without Udyam Registration?

No, a business cannot be treated as an MSME without Udyam Registration. As of 2026, only units registered on the official Udyam Portal are legally recognized as MSMEs in India.

What happens if Udyog Aadhaar is not migrated to Udyam?

If Udyog Aadhaar is not migrated, the unit loses MSME status. It becomes ineligible for MSME benefits such as Mudra loans, CGTMSE coverage, government tenders, subsidies, and priority sector lending.

Is Udyam Registration mandatory for MSME benefits?

Yes, Udyam Registration is mandatory to claim any MSME benefits in 2026. Without a valid Udyam certificate, businesses cannot access government schemes, bank loans under MSME category, or MSME tender advantages.

What is the last date to migrate Udyog Aadhaar to Udyam?

The final deadline to migrate Udyog Aadhaar to Udyam was June 30, 2022. After this date, unmigrated Udyog Aadhaar registrations ceased to be valid for MSME recognition.

Can banks accept Udyog Aadhaar as MSME proof in 2026?

No, banks do not accept Udyog Aadhaar as MSME proof in 2026. Banks, NBFCs, and financial institutions recognize only Udyam Registration certificates for MSME classification and lending benefits.

Is Udyam Registration lifetime or needs renewal?

Udyam Registration has lifetime validity and does not require renewal. However, enterprises must update information if there are changes in turnover, investment, or business structure.

Can a business apply fresh Udyam Registration without Udyog Aadhaar?

Yes, businesses can apply directly for fresh Udyam Registration even without Udyog Aadhaar. Aadhaar and PAN details are sufficient to complete the registration on the official Udyam Portal.

Is Udyam Registration compulsory for government tenders?

Yes, Udyam Registration is compulsory to claim MSME benefits in government tenders. Units without Udyam registration are treated as non-MSME and cannot avail MSME exemptions or preferences.

Are private Udyam registration websites valid?

No, private websites are not authorized to issue MSME registration. Only the official government-managed Udyam Portal is valid. Certificates or registrations from private portals have no legal value.

How does the government verify MSME status in 2026?

The government verifies MSME status through the Udyam Portal using Aadhaar, PAN, GST, and Income Tax data. Manual or self-declared registrations like Udyog Aadhaar are no longer accepted.

Can MSME status be backdated after Udyam registration?

No, MSME status is effective only from the date of successful Udyam Registration. Benefits cannot be claimed retroactively for the period when the unit was not registered under Udyam.

Is Udyam Registration required for old businesses?

Yes, all businesses—old or new—must have Udyam Registration to be recognized as MSMEs in 2026. Business age or prior Udyog Aadhaar registration does not exempt a unit from this requirement.

What is the official website for Udyam Registration?

The official MSME registration website is the government-managed Udyam Registration Portal. No other platform is legally authorized to issue MSME registration certificates.