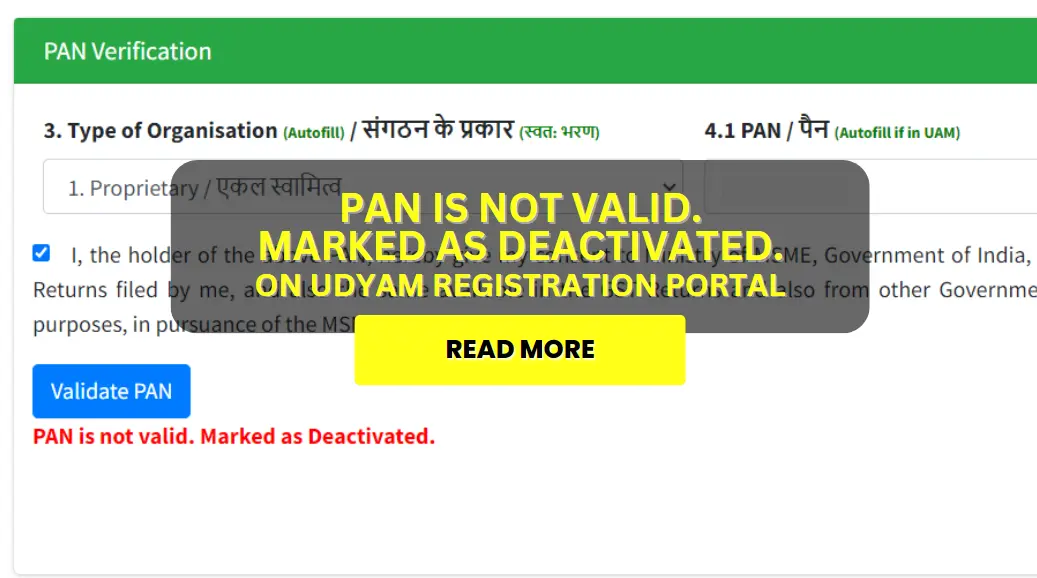

Here we will learn about this problem “Pan is Not Valid. Marked as Deactivated. On Udyam Registration Portal getting this error while registration. So what to do and the solution for it.

The Udyam Registration Portal has been a significant step towards simplifying the process of registering for the Micro, Small, and Medium Enterprises (MSMEs) in India. It aims to provide various benefits to these enterprises, such as easier access to credit, loans, and government subsidies. However, a common issue that users face while registering on the portal is encountering an error message that states their PAN (Permanent Account Number) is marked as deactivated.

We are available to answer your questions. Send us a WhatsApp message and we’ll respond as soon as we’re available! Send us a WhatsApp message.

The Udyam Registration Portal has been a game-changer for small businesses in India, simplifying the process of obtaining a unique identification number. However, some entrepreneurs have encountered a frustrating roadblock when their PAN (Permanent Account Number) is marked as “Not Valid” or “Deactivated.” In this blog post, we will explore the reasons behind this error and provide guidance on what steps to take if you find yourself facing this issue. Let’s dive in and understand how to overcome the Udyam registration PAN validation error.

Understanding the Udyam Registration PAN Validation & Deactivated Error

The Udyam Registration Portal requires entrepreneurs to provide their PAN as part of the registration process. PAN is a unique ten-digit alphanumeric code issued by the Income Tax Department of India. It serves as an essential identification document for individuals and businesses for various financial transactions.

However, some entrepreneurs have reported encountering an error message stating that their PAN is “Not Valid” or “Deactivated” during the Udyam registration process. This error can be frustrating and confusing, as it prevents them from completing their registration and accessing the benefits offered by the Udyam Registration Portal.

Reasons Behind the PAN Validation & Deactivated Error

There can be several reasons why a PAN can be marked as “Not Valid” or “Deactivated” on the Udyam Registration Portal. One common reason is discrepancies in the information provided during the registration process. It is crucial to ensure that the PAN details entered, such as name, date of birth, and address, match the information registered with the Income Tax Department.

Another reason for the error could be non-compliance with tax regulations. If an entrepreneur has failed to file income tax returns or has outstanding tax liabilities, their PAN may be deactivated, leading to the validation error on the Udyam Registration Portal.

Steps to Resolve the PAN Validation Error

If your PAN is marked as “Not Valid” or “Deactivated” on the Udyam Registration Portal, below are the steps you can take to resolve the issue. This error can be frustrating for MSME owners, as it prevents them from completing their registration and accessing the benefits offered by the Udyam Registration Portal. If you are facing this issue, here are a few steps to help resolve it:

1. Verify the PAN provided:

The first step is to ensure that the PAN you have entered during the registration process is accurate and valid. You can cross-check the details on your physical PAN card or through the Income Tax Department’s official website. Ensure that the name, date of birth, and address match the information registered with the Income Tax Department. If there are any discrepancies, update the details accordingly. Any errors in the PAN number could lead to deactivation status on the Udyam Registration Portal.

2. Contact the Income Tax Department:

If you have verified that the PAN number is correct, check whether it is still valid and active. If you believe that your PAN is valid and active, but it is still marked as “Not Valid” or “Deactivated” on the Udyam Registration Portal, reach out to the Income Tax Department. Contact their helpline or visit the nearest tax office to seek clarification and resolve any issues related to your PAN. PAN deactivation can occur due to various reasons such as non-filing of income tax returns, incorrect filing, or non-compliance with the tax regulations. To resolve this, you need to contact the concerned authority in the Income Tax Department and rectify any issues related to your PAN’s deactivation.

3. File pending income tax returns:

In some cases, if you have not filed your income tax returns or have pending returns for previous years, your PAN may be marked as deactivated. It is crucial to clear any pending returns and ensure that your tax filings are up to date. Once you have filed your returns, the deactivation status on your PAN may be lifted.

Also read this blog for Verify Pan Number For Udyam Registration

4. Contact the Income Tax Department:

If you have verified and rectified all the issues with your PAN but are still facing deactivation status on the Udyam Registration Portal, it is recommended to get in touch with the Income Tax Department directly. You can visit their website or reach out to the helpline numbers provided for further assistance. They will be able to guide you through the process of reactivation or resolving any other issues related to your PAN.

5. Seek professional help:

If you are facing difficulties in resolving the deactivation status on your PAN, it may be beneficial to seek assistance from a qualified professional, such as a chartered accountant or a tax consultant. They have expertise in dealing with such matters and can guide you through the process, saving you time and effort.

Follow us on Google News for the latest updates on Startups / finance/ MSME / Insurances.

In conclusion, if you encounter the error message stating that your PAN is not valid and marked as deactivated on the Udyam Registration Portal, it is essential to verify the PAN’s accuracy, check its validity, file any pending income tax returns, and reach out to the Income Tax Department for further assistance. Remember, seeking professional help can also be a wise choice to resolve any complicated issues related to your PAN. With the right guidance and steps, you can overcome this obstacle and complete your registration on the Udyam Registration Portal, accessing the benefits it offers for your MSME.

We are available to answer your questions. Send us a WhatsApp message and we’ll respond as soon as we’re available! Send us a WhatsApp message.

The Udyam Registration Portal has revolutionized the way small businesses register and operate in India. However, encountering a PAN validation error can be a roadblock for entrepreneurs. By understanding the reasons behind the error and following the steps mentioned above, you can resolve the issue and proceed with your Udyam registration. Remember to verify your PAN details, contact the Income Tax Department if needed, address any tax compliance issues, and seek professional assistance if required. With persistence and the right approach, you can overcome the PAN validation error and unlock the benefits offered by the Udyam Registration Portal.

FAQ on Pan is Not Valid Marked as Deactivated on Udyam Registration Portal

How much time it will take to resolve this PAN Validation & Deactivated ?

The time required to resolve PAN validation and deactivation issues varies and depends on the specific circumstances; it is advisable to contact the relevant authorities for a more accurate estimate.