Udyam is a government registration system introduced to promote the growth of MSMEs in India, replacing the earlier MSME registration process. This article covers the differences between the two processes, the role of Udyam in supporting MSMEs during COVID-19, and the future of MSMEs in India with Udyam, highlighting the benefits for MSMEs and the importance of registering for Udyam.

Udyam and MSME refer to a scheme and a category of businesses in India respectively. Here’s an overview of each:

Udyam:

Udyam is a government-run online portal for registering and obtaining a unique identification number (Udyam Registration) for Micro, Small, and Medium Enterprises (MSMEs) in India. The Udyam Registration replaced the earlier system of registration known as Udyog Aadhaar Memorandum (UAM) from 1st July 2020.

MSME:

MSME stands for Micro, Small, and Medium Enterprises. These are small businesses that operate in various sectors and contribute significantly to the Indian economy. The definition of MSMEs in India was revised in 2020, where the criteria for classification are based on annual turnover and investment in plant and machinery or equipment. The revised definition of MSMEs is as follows:

- Micro-enterprise: Annual turnover of up to Rs. 5 crore and investment of up to Rs. 1 crore.

- Small enterprise: Annual turnover of up to Rs. 50 crore and investment of up to Rs. 10 crore.

- Medium enterprise: Annual turnover of up to Rs. 250 crore and investment of up to Rs. 50 crore.

MSMEs are eligible for various benefits and schemes provided by the government to support their growth and development.

Importance to the Indian economy on Udyam and MSME

Udyam and MSMEs play a crucial role in the Indian economy. Here are some of the reasons why:

- Employment Generation: MSMEs are the largest employers in India after agriculture, providing employment to millions of people across the country. By encouraging the growth of MSMEs through initiatives like Udyam Registration, the government is supporting job creation and reducing unemployment.

- GDP Contribution: MSMEs contribute significantly to the GDP of India, accounting for nearly 30% of the country’s GDP. This shows how crucial they are to the growth and development of the Indian economy.

- Innovation and Entrepreneurship: MSMEs are often the breeding ground for innovation and entrepreneurship. By promoting MSMEs, the government is encouraging the growth of a culture of innovation and entrepreneurship, which can lead to new businesses, new products and services, and economic growth.

- Regional Development: MSMEs are distributed across various regions of India and play a critical role in the economic development of these regions. They help in creating new industries, improving infrastructure, and promoting local economic activity.

- Export Growth: MSMEs also play a critical role in promoting export growth, as they account for a significant portion of India’s export earnings. By encouraging MSMEs to export their products and services, the government is boosting foreign exchange earnings and improving the balance of trade.

Udyam and MSMEs are vital to the Indian economy, and their growth and development are crucial for the country’s continued economic success. By promoting and supporting MSMEs, the government is helping to create jobs, boost GDP, promote innovation and entrepreneurship, support regional development, and boost export growth.

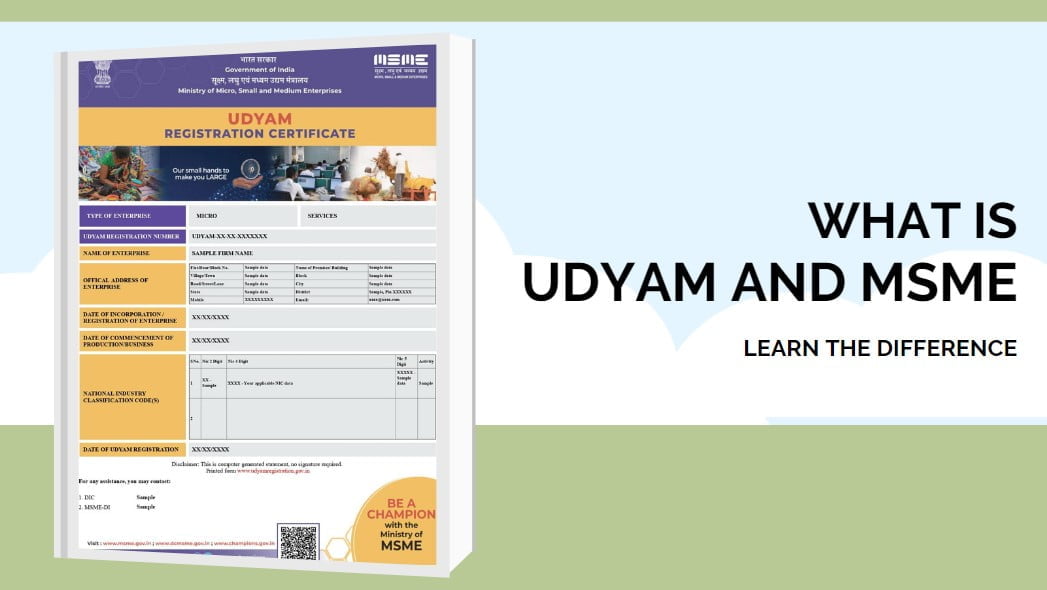

What Udyam Registration is?

Udyam Registration is an online registration process introduced by the Indian government to help Micro, Small, and Medium Enterprises (MSMEs) obtain a unique identification number (Udyam Registration Number). It replaces the earlier system of registration known as Udyog Aadhaar Memorandum (UAM), which was used to register MSMEs in India.

Udyam Registration is a one-time registration process that requires the MSMEs to provide certain details about their business, such as their name, PAN number, Aadhaar number, business type, and bank account details. Once registered, the MSMEs are provided with a Udyam Registration Certificate, which contains details such as the Udyam Registration Number, name of the enterprise, type of enterprise, and date of issue.

The Udyam Registration process is entirely online and can be done on the official Udyam Registration portal. MSMEs can also update their details or make any changes to their registration online. The Udyam Registration process is entirely free of cost, and there is no fee charged for obtaining the Udyam Registration Certificate.

The benefits of Udyam Registration include access to various government schemes, subsidies, and incentives, as well as priority sector lending by banks. It also helps in getting various approvals, licenses, and certifications from various government departments easily.

Udyam Registration is a simple and hassle-free way for MSMEs to obtain a unique identification number and access various benefits and schemes offered by the government. MSMEs can avail themselves of this opportunity to grow their businesses and contribute to the growth and development of the Indian economy.

What is the process of getting a Udyam Registration?

The process of obtaining a Udyam Registration is quite simple and can be done online through the official Udyam Registration portal. Here’s a step-by-step guide to the process:

Step 1: Visit the Udyam Registration portal.

Step 2: Click on the “For New Entrepreneurs who are not registered yet as MSME” button.

Step 3: Enter your 12-digit Aadhaar number and click on “Validate and Generate OTP.” An OTP will be sent to your registered mobile number linked with Aadhaar.

Step 4: Enter the OTP received and click on “Verify OTP.”

Step 5: Enter the required details such as name of the enterprise, type of enterprise, PAN number, bank account details, and other relevant information.

Step 6: Click on “Submit.” An application reference number will be generated, which can be used to track the status of your application.

Step 7: Once your application is verified, you will receive your Udyam Registration Number and a Udyam Registration Certificate.

It is important to note that Udyam Registration is a one-time process, and there is no need to renew it. However, MSMEs are required to update their registration details in case of any changes. Before going for do check some of the documents required for getting udyam registration certificate.

Obtaining a Udyam Registration is a simple and hassle-free process that can be done online. MSMEs can benefit from the various schemes, incentives, and priority sector lending available to registered MSMEs, making it an important step in the growth and development of their business.

What MSMEs are?

MSMEs are Micro, Small, and Medium Enterprises. These are small-scale industries that play a significant role in the economic development of India. The Government of India has defined MSMEs based on their investment in plant and machinery or equipment for manufacturing or service sector enterprises.

As per the current definition, the MSMEs are classified based on their investment in plant and machinery or equipment as follows:

- Micro Enterprises: Micro enterprises are those enterprises where the investment in plant and machinery or equipment does not exceed Rs. 1 crore and for service sector enterprises, it should not exceed Rs. 5 crore.

- Small Enterprises: Small enterprises are those enterprises where the investment in plant and machinery or equipment is more than Rs. 1 crore but does not exceed Rs. 10 crore and for service sector enterprises, it should not exceed Rs. 50 crore.

- Medium Enterprises: Medium enterprises are those enterprises where the investment in plant and machinery or equipment is more than Rs. 10 crore but does not exceed Rs. 50 crore and for service sector enterprises, it should not exceed Rs. 250 crore.

MSMEs are spread across various sectors such as manufacturing, services, agriculture, and others. They provide employment to millions of people and play a crucial role in the economic growth and development of India. The government provides various schemes, incentives, and support to promote and develop MSMEs in the country.

What is the revised definition of MSMEs in India?

The Indian government revised the definition of MSMEs in June 2020 to provide a broader and more inclusive definition. The revised definition is based on both investment and turnover criteria, which replaced the earlier investment-based criteria.

According to the revised definition, the MSMEs are classified as follows:

- Micro Enterprises: Micro enterprises are those enterprises where the investment in plant and machinery or equipment and turnover does not exceed Rs. 1 crore and Rs. 5 crore, respectively.

- Small Enterprises: Small enterprises are those enterprises where the investment in plant and machinery or equipment and turnover is more than Rs. 1 crore but does not exceed Rs. 10 crore and Rs. 50 crore, respectively.

- Medium Enterprises: Medium enterprises are those enterprises where the investment in plant and machinery or equipment and turnover is more than Rs. 10 crore but does not exceed Rs. 50 crore and Rs. 250 crore, respectively.

The revised definition aims to provide relief to small businesses that face challenges in raising capital and growing their businesses. It also encourages the growth of businesses that have potential for growth and have the capacity to contribute to the economic development of the country.

The revised definition of MSMEs in India provides a broader and more inclusive definition that aims to provide support and encouragement to small businesses in the country. The new definition considers both investment and turnover criteria, making it easier for businesses to grow and contribute to the economy.

The contribution of MSMEs to the Indian economy.

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy, accounting for a significant share of the country’s industrial output, exports, and employment generation. They play a crucial role in promoting inclusive growth and regional development, particularly in rural and semi-urban areas. MSMEs have emerged as a vital source of innovation and entrepreneurship, contributing to the country’s economic growth and development. Here we will highlight the contribution of MSMEs to the Indian economy, including their role in employment generation, GDP contribution, export promotion, entrepreneurship, inclusive growth, and regional development. By understanding the importance of MSMEs in the Indian economy, we can better appreciate their significance and the need to support and promote their growth.

Micro, Small, and Medium Enterprises (MSMEs) play a vital role in the Indian economy. Here are some of their significant contributions:

- Employment Generation: MSMEs are the largest employer in India after agriculture. They employ more than 110 million people across the country. They create job opportunities, especially in rural and semi-urban areas, contributing to the reduction of unemployment and poverty.

- GDP Contribution: MSMEs account for approximately 30% of India’s GDP. They contribute to the country’s economic growth by producing goods and services, creating value, and generating revenue.

- Export Promotion: MSMEs contribute to India’s export by manufacturing and exporting goods to other countries. They account for about 40% of India’s total exports.

- Entrepreneurship: MSMEs encourage entrepreneurship by providing opportunities to people to start their own businesses. They foster innovation, creativity, and skill development, which contributes to the country’s economic growth.

- Inclusive Growth: MSMEs help in promoting inclusive growth by creating job opportunities for people from diverse backgrounds, including women and marginalized communities.

- Regional Development: MSMEs play a significant role in the development of backward regions and small towns. They create employment opportunities, promote local entrepreneurship, and contribute to the overall economic development of these areas.

MSMEs are an essential part of the Indian economy. Their contributions to employment generation, GDP, export promotion, entrepreneurship, inclusive growth, and regional development are significant and cannot be overlooked.

How does udyam registration differ from the previous MSME registration process?

The Udyam registration process was introduced on July 1, 2020, as a replacement for the previous MSME registration process. Here are the key differences between the two:

Registration process:

The previous MSME registration process required entrepreneurs to fill in a form and submit it to the District Industries Centre (DIC) or the Ministry of MSMEs. However, with the introduction of Udyam, the registration process has become completely online. Entrepreneurs can now register for Udyam through the Udyam Registration portal.

Definition of MSMEs:

The definition of MSMEs has been revised under Udyam. The previous definition was based on the investment made in plant and machinery or equipment. The new definition is based on the investment made in plant and machinery or equipment, as well as the turnover of the enterprise. This means that an enterprise with a higher turnover can still be classified as a small enterprise if the investment in plant and machinery is within the prescribed limit.

Eligibility criteria:

Under the previous MSME registration process, only manufacturing and service enterprises could register. However, under Udyam, other types of enterprises, such as trading enterprises and enterprises engaged in the production of renewable energy, can also register.

Validity of registration:

Under the previous MSME registration process, registration was valid for a lifetime. However, with the introduction of Udyam, registration is valid for only five years. Entrepreneurs need to renew their registration after five years to continue to avail of the benefits.

Registration fee:

Under the previous MSME registration process, there was some fee for registration. However, under Udyam, entrepreneurs need to pay a fee for registration. The fee varies depending on the type of enterprise.

Documentation:

Under the previous MSME registration process, entrepreneurs needed to submit various documents, such as proof of ownership, proof of address, and bank account details. However, with the introduction of Udyam, the documentation requirements have been reduced. Entrepreneurs now only need to provide their Aadhaar number and PAN card details to register.

In summary, the introduction of Udyam has made the registration process simpler and more streamlined for MSMEs. It has also expanded the definition of MSMEs and made registration mandatory for enterprises engaged in trading and renewable energy production. However, the registration fee and the requirement to renew registration after five years are new features that were not present in the previous registration process.

Role of Udyam in supporting MSMEs during COVID-19

The COVID-19 pandemic has had a significant impact on MSMEs in India. The nationwide lockdown and subsequent restrictions on economic activities have led to a decline in demand, supply chain disruptions, and cash flow problems for MSMEs. In this context, the Udyam registration system has played an important role in supporting MSMEs during these challenging times. Here are some ways in which Udyam has supported MSMEs during the COVID-19 pandemic:

Easy access to credit:

Udyam registration has made it easier for MSMEs to access credit from financial institutions. MSMEs registered under Udyam are eligible for various government schemes and subsidies, including the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). The CGTMSE provides collateral-free credit to MSMEs, and Udyam registration is a prerequisite for availing of this facility.

Government subsidies:

Udyam registration has made MSMEs eligible for various government subsidies and schemes, such as the Prime Minister’s Employment Generation Programme (PMEGP), which provides financial assistance for setting up new enterprises. The government has also announced various relief measures for MSMEs during the pandemic, such as the Atmanirbhar Bharat Abhiyan, which provides a stimulus package for MSMEs.

Facilitating digital transformation:

The pandemic has accelerated the adoption of digital technologies in businesses. Udyam registration has made it mandatory for MSMEs to provide their email and mobile number, which can be used to promote digital payments and online transactions. This has helped MSMEs to adapt to the new normal and continue their business operations despite the restrictions on physical movement.

Increased visibility:

Udyam registration has increased the visibility of MSMEs by providing them with a unique identification number (UIN). This UIN can be used to promote their products and services and attract new customers. This has helped MSMEs to overcome the decline in demand caused by the pandemic and expand their customer base.

Udyam registration has played an important role in supporting MSMEs during the COVID-19 pandemic by facilitating easy access to credit, government subsidies, and promoting digital transformation. It has helped MSMEs to overcome the challenges posed by the pandemic and emerge stronger.

Udyam is a government registration system introduced to replace the earlier MSME registration process in India. It is a significant step towards promoting the growth of MSMEs in India, which play a crucial role in the country’s economy. Udyam registration provides various benefits for MSMEs, including easy access to credit, government subsidies, digital transformation, and increased visibility. Additionally, during the COVID-19 pandemic, Udyam has played a critical role in supporting MSMEs by providing various relief measures. With Udyam, the future of MSMEs in India looks promising, and MSME owners should not hesitate to register for it and take advantage of the benefits it offers. Overall, Udyam is a crucial tool for promoting the growth of MSMEs in India, and it is essential that all eligible enterprises register for it.