Learn the msme udyam benefits for businesses who wants to register under the Ministry of MSME & then be a part of government schemes.

The Ministry of Micro, Small and Medium Enterprises of the Government of India notified a composite criteria consisting of both investment and turnover as criteria for classifying enterprises as Micro, Small and Medium Enterprises with effect from July 1, 2020 via Gazette of India, Extraordinary, Part-II, Section-3, Sub-Section (ii).

This method would make it simpler for MSMEs to get permanent registration, which is known as ‘Udyam Registration’.

In order to conform with the new MSMEs criteria and streamline business operations in India.

Salient features of Udyam Registration:

The Udyam Registration for the business may be obtained by anyone. It is possible to register using the portal, which is https://udyamregistrationform.com/

The Udyam Registration procedure is completely digital and paperless. There is no need to attach any files.

The registration procedure is completely online. There is no need to go to the government office and departments or costs to be paid to anybody.

On completion, an e-certificate titled “Udyam Registration Certificate” will be provided online.

This certificate includes a dynamic QR code that can be used to visit a web page on udyam portal as well as information about the company.

Anyone who willfully misrepresents or tries to hide self-declared facts and figures in the Udyam Registration or updation procedure will be subject to the penalties set out in section 27 of the Act.

The online msme udyam system is fully integrated with other government portals, such as the Income Tax (IT) and Goods and Services Tax Identification Number (GSTIN) systems, allowing for instant access to data on a company’s investment and turnover from government databases. Exports are not taken into account while calculating turnover.

Those who have an EM-II or UAM registration, or any other registration granted by a Ministry of MSME authority, must re-register by March 31, 2021.

There may be no more than one Udyam Registration per business. In one Registration, however, any number of activities, including production, service, or both, may be defined or added.

Requirement for Udyam Registration Certificate:

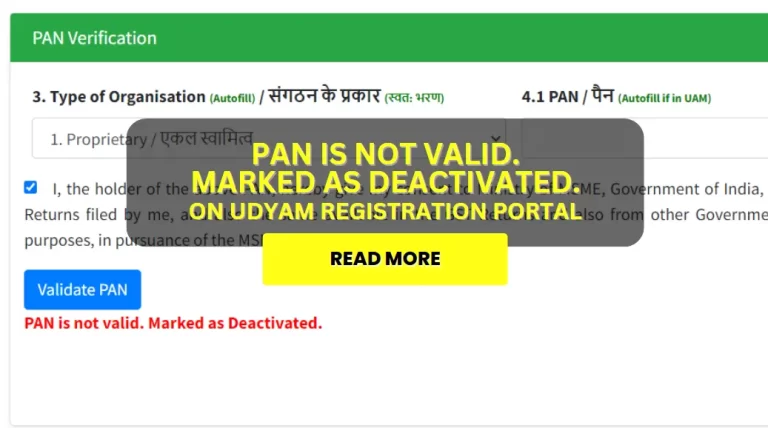

For registration, you only need your Aadhar number.

From April 1, 2021, having a PAN and a GST number is required.

MSME Udyam Benefits of this registration:

It will be a company’s permanent registration and basic identifying number.

MSME registration is based on self-declaration and is done without the use of paper.

Registration will not be required to be renewed.

In a single Registration, any number of activities, including manufacturing, service, or both, can be defined or added.

In addition to Udyam Registration, MSME of manufacturing, service or traders enterprises can register on GeM (Government e-Marketplace, a portal for G to B) and SAMADHAAN Portal (a portal to address issues relating to payment delays), and MSMEs can register on TReDS Platform (a platform where invoices of receivables are traded) through three available platforms, i.e.

1. www.invoicemart.com

2. www.m1xchange.com

3. www.rxil.in

The Udyam Registration may also enable MSMEs to benefit from the Ministry of MSMEs scheme and programmes such as the Credit Guarantee Scheme, Public Procurement Policy, a competitive advantage in government bids, and protection against late payments, among others.

Financial institutes and Banks are now willing to lend to the priority sector.

Priority Sector Lending:

The Reserve Bank of India publishes the Priority Sector Lending (PSL) guidelines. In its circular number RBI/FIDD/2020-21/72 Master Directions FIDD.CO.Plan.BC.5/04.09.01/2020-21 dated September 04, 2020, the RBI provided rules on Priority Sector Lending.

As a result, the priority sector’s categories are as follows:

(i) Agriculture

(ii) Micro, Small andMedium Enterprises

(iii) Export Credit

(iv) Education

(v) Housing

(vi) Social Infrastructure

(vii) Renewable Energy

(viii) Others.

As a result, MSME (Micro small and medium enterprise) lending is classified as Priority Sector Lending.

According to RBI, the definition of MSMEs will be as per Government of India (GoI), Gazette Notification S.O. 2119 (E) dated June 26, 2020 read with circular RBI/2020-2021/10 FIDD.MSME & NFS.BC.No.3/06.02.31/2020-21 read with FIDD.MSME & NFS. BC. No.4 / 06.02.31/2020-21 dated July 2, 2020, August 21, 2020 on ‘Credit flow to Micro Small and Medium Enterprises Sector’ and updated from time to time.

Furthermore, such MSMEs must be engaged in the manufacturing or production of items in any industry mentioned in the First Schedule to the Industries (Development and Regulation) Act, 1951, or in the provision or rendering of any service or services.

All bank loans to SMEs that comply with RBI standards are classified as priority sector lending.

We trust that this essay has shed some light on the new MSME udyam benefits and advantages. Fill out this udyam application form if you’re searching for an udyam certificate. After paying for the service online, your udyam certificate will be emailed to your registered email address.

If you want any clarification, please contact us by filling the contact form.

Also Read these MSME Articels:

Benefits of Udyam Registration

New MSME Classification – Micro Small Medium Enterprises

Online Udyam Registration Portal

Benefits of new Income Tax e-filing Portal in Hindi – नई आयकर इ-फ़ाईलिंग पोर्टल के फायदे ।

Difference between old and new Income Tax e-filing Portal in Hindi

New Income Tax e-filing Portal नई आयकर इ-फ़ाईलिंग पोर्टल हिन्दी में ।

Udyam Registration Benefits in Hindi -उद्यम रेजिस्ट्रैशन सर्टिफिकेट के फायदे

Udyam registration certificate kya hai – उद्यम रजिस्ट्रेशन सर्टिफिकेट क्या है

Udyam Registration NIC Code List – MSME NIC Code List

Is Udyam Registration Mandatory?

Get your Udyam Registration Now