Are you interested to learn about forensic accounting in India for your career or just to gain knowledge? We have now covered every aspect of financial forensic accounting in this post.

What is Forensic Accounting in India?

The definition of forensic accounting in India is a financial experts that specialise in detailed financial accounting that help resolve legal issues involving claims of business misbehaviour, fraud, and other wrongdoing.

Forensic accounting employs accounting, auditing, and investigative abilities to perform an inquiry into the finances of a person or corporation. Forensic Accounting offers an accounting analysis acceptable to be utilized in judicial processes. Forensic accountants are educated to see beyond the statistics and deal with the commercial realities of a scenario. Forensic accounting is widely used in fraud and embezzlement cases to explain the nature of a financial crime in court.

A forensic accountant’s job is to gather financial evidence, create software to organize and analyze the data, and deliver the results to the client. Experts in forensic accounting dissect and explain complex business and financial data in order to provide concise summaries and recommendations. They could work for a variety of organizations, including banks, governments, police forces, and public accounting firms.

In addition to giving testimony in court, a forensic accountant may be required to provide exhibits to bolster the prosecution’s case. Due to their extensive experience with legal matters and knowledge with the court system, forensic accountants may decide to pursue extra training in alternative dispute resolution (ADR). Money tracking, asset identification, asset recovery, and due diligence evaluations are all tools used in forensic accounting investigations.

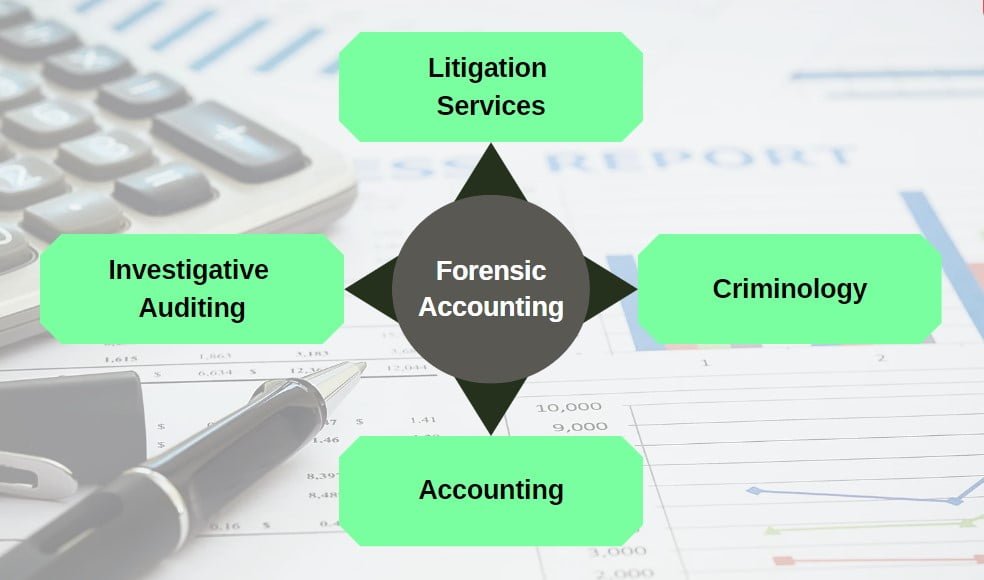

Litigation Support through Forensic Accounting:

The quantitative information is used by the parties in a legal dispute to help reach a settlement or a ruling. Conflicts in this area might result, for instance, from disagreements about pay and benefits. Forensic accountants are called upon in the courtroom whenever the need arises to put a monetary value on losses. The forensic accountant might testify as an expert witness if the matter ends in court.

Two Applications of Forensic Accounting in Criminal Investigation:

Discovering if a crime happened and evaluating the likeliness of criminal intent are two more uses for forensic accounting. Theft by employees, for example, securities fraud, or even identity theft or insurance fraud, are all models of this kind of crime.

Complex and highly publicized financial crimes often use the services of forensic accountants. Forensic accountants helped the court grasp Bernie Madoff’s Ponzi scheme, for instance, by breaking it down into manageable pieces.

It is relatively uncommon for forensic accountants to be called upon to aid in the discovery of hidden assets during a divorce proceeding and for use in other civil issues such as contract or tort disputes, acquisition conflicts, warranty claims, and business valuation problems.

Construction disputes, expropriations, product liability claims, and trademark or patent infringements are some cases that a forensic accountant could be called upon to investigate. What’s more, if that weren’t enough, forensic accounting may be used to calculate the financial fallout from violating a non-compete or non-disclosure agreement.

Insurance Industry Forensic Accounting:

The insurance sector often makes use of forensic accounting. In this role, a forensic accountant may be requested to calculate the monetary losses associated with a personal injury lawsuit, medical malpractice suit, or car crash. An issue with using forensic accountants to handle insurance claims instead of regular adjusters is that they tend to focus on the past and overlook new evidence that might significantly alter their initial assessment of the claim.

The Various Forms of Forensic Accounting:

Several forms of forensic audits may take place, and they are often classified by the types of judicial processes they come under. Some typical instances are shown below:

- Stealing money from a bank (customers, employees, or outsiders)

- Swindling investors

- Bankruptcy

- Debt nonpayment

- Economic damages (different forms of litigation to collect losses) (various types of lawsuits to recover damages)

- M&A related litigation

- Tax avoidance or fraud

- Disputes about the value of a company

- Professional negligence claims

- Money laundering

- Data Protection Specifics

- Divorce proceedings

Forensic Accounting Jobs & Careers:

There is a large variety of job choices available for accountants who wish to go into forensic accounting. Depending on the client being represented and the nature of the trial, the labor and duty might be radically different. For example, working on a personal divorce vs. the Enron affair would be very different.

These expert accountants’ duties include detecting fraud, calculating damages, valuing a corporation, or analyzing tax obligations.

Career pathways into the post might vary, although they often involve years of standard audit experience at a public accounting firm. There are many professional accreditations that accountants may get to improve a career in forensic accounting.

- Chartered Financial Analyst® (CFA®) credential

- Obtaining your CPA license shows that you are a competent and trustworthy accountant.

- A certificate from the Chartered Alternative Investment Analyst (CAIA®) Institute

- CFP® (Certified Financial Planner®)

- The Certified Financial Risk Manager (FRM®) designation

- Certification as a Financial Modeler and Valuer (FMVA)

Working of Forensic Accounting:

Forensic accounting utilizes scientific methodologies and accounting concepts to discover fraudulent actions. Due to technology innovation, corporate frauds have expanded tremendously—the necessity for forensic accountants has skyrocketed.

A single individual cannot perform forensic processes—it is carried out by an organized team of professionals—certified Public Accountants

\s (CPAs) and forensic accountants. The team is liable for the following tasks:

- The forensic team gathers facts and evidence relevant to undisclosed assets.

- To gather evidence, forensic accountants often speak with business partners and staff.

- Then they check the obtained data.

- This data is evaluated extensively.

- The findings are summarized in reports.

- The evidence is packaged into exhibits—to be submitted in a court of law.

- Sometimes, the forensic staff is needed to testify, defending the accuracy of reports.

Applications of Forensic Accounting:

Topping the list is fraud in the business world.

Professionals in forensic accounting plan intelligence operations and track down criminals. Asset tracing, interviewing suspects, conducting interviews with witnesses, conducting due diligence evaluations, and recovering stolen assets are all parts of a business investigation. For such inquiries, it is necessary to sift through the paper trail.

Concealment of Taxes Owed

Forensic accountants uncover financial crimes. Falsifying income and other financial data are shared among organizations and individuals looking to minimize tax obligations.

Stock Market Fraud

The most widespread white-collar crime is the fraudulent representation of commodities, stocks, and other assets. Fraudulent late-day trading, pump-and-dump, pyramid, and Ponzi schemes are all illegal financial practices.

The Theft or Hiding of Assets

The tax authorities often find themselves on the receiving end of wealth concealment schemes from both individuals and corporations. Forensic accountants investigate cases of theft, embezzlement, and payroll fraud involving company assets.

Controversy over Shareholding Org:

CPAs also look at salaries and perks received by shareholders or partners to see potential conflicts of interest. The investigators will look closely at accounting and financial records to put a number on the problems that the dispute has exposed.

Insurance Claims:

Experts in forensic accounting determine monetary losses due to car accidents and medical malpractice. They look into cases of property damage, company losses, employee fidelity claims, and similar litigation on behalf of insurance providers and policyholders. There is an examination of insurance plans, coverage questions, claim payments, and loss estimation.

Financial Devastation and Insolvency:

Common causes of financial loss for businesses include legal actions taken due to violations of contracts, construction claims, trademark or patent infringements, product liability claims, and breaches of non-compete agreements. Expert forensic accountants investigate the history of events leading up to the lawsuit. They put a number on the damage. Moreover, in bankruptcies, accountants carry out recovery processes.

Money-washing:

Money laundering and secret bank accounts are only two of the illegal ways that forensic accountants find illicit funding.

Family and marital strife:

Accountants determine monetary compensation in cases of divorce, property disputes, and family issues once damages are quantified. They put an economic value on the benefits of child and spousal support. CPAs are often brought in to settle cases of disputed property ownership amongst family members.

Procedures used in Forensic Accounting:

In order to tell the difference between an honest error and a fraudulent one, mathematicians employ Benford’s law. Additionally, the Relative Size Factor (RSF) method further explores record outliers.

Data-mining software may automatically sift through large datasets in search of previously unknown information or hidden patterns. To extract data and analyze finances, forensic accountants employ a wide variety of computer programs.

Also read: Best Retail Management Accounting Software For Small Business

Final Thoughts on Financial Forensics:

Professionals who specialize in this type of accounting don’t just examine financial statements: They take a holistic approach, incorporating statistical analysis, big data and machine learning, interviews, and physical observation to arrive at the truth.

Any forensic accountant worth their salt will start by poring through the company’s financial statements, including the balance sheet, income statement, and cash flow statement, whether the inquiry is being conducted for due diligence or compliance. They look at the company’s self-reported value to make sense, compare transactions to records kept by counterparties, and analyze share ownership to see how it stacks up over time and against the competition.

Author’s Bio:

Samuel Dawson loves helping others to thrive online through Social Media, Blogging, and SEO. What good is knowledge if you cannot share it with others? He has 30+ years of experience in marketing/advertising with 10 years of experience in content marketing, social media, blogging, and SEO.

He spent his last decade reading and writing blogs and his words show new colors of life to readers. He was invited as a guest to a renowned College to distribute awards for creative writing. Also, he is a professional architect and loves observing the kids’ behavior towards their elders.