Priority Sector Lending (PSL) plays a crucial role in promoting inclusive growth and ensuring equitable access to financial services. With a focus on specific sectors that contribute to the overall development of the economy, PSL aims to uplift marginalized sections of society, foster entrepreneurship, and strengthen key sectors such as agriculture, micro, small, and medium enterprises (MSMEs), education, and housing. In this article, we will explore the concept of Priority Sector Lending, its importance, benefits, government initiatives, challenges, and how individuals and organizations can avail themselves of its advantages.

Introduction on Availing Benefits of Priority Sector Lending (PSL)

As an integral part of the financial system, Priority Sector Lending (PSL) is a mechanism that mandates banks and financial institutions to allocate a certain percentage of their total lending towards identified priority sectors. The objective is to ensure that adequate credit is available to sectors that have historically faced challenges in accessing finance from traditional sources. By focusing on priority sectors, PSL aims to create a more inclusive and sustainable economy.

The Reserve Bank of India makes the decision to allocate funds to predefined priority economic sectors that may need credit and financial help, especially in situations where the absence of PSL will, in certain cases, result in significant losses to the sector’s players. Priority Industries The RBI acts as a lender to banks, pleading with them to set aside money for particular economic sectors including agriculture and related businesses, education, and shelter and food for those in need.

What is Priority Sector Lending (PSL)?

Priority Sector Lending (PSL) refers to the lending obligations imposed on banks by the Reserve Bank of India (RBI) to ensure that a portion of their lending is directed towards sectors identified as “priority.” These sectors are crucial for the overall development of the country and include agriculture, MSMEs, education, housing, export credit, and more. PSL guidelines are periodically reviewed and revised by the RBI to align with changing economic priorities.

Check if your business come under Priority sector lending (PSL) or not?

Priority Sector Lending (PSL): An Overview

Instead of funding primarily lucrative industries or areas that are essential to economic progress, the objective of a PSL programme is to extend credit to the less fortunate segments of society. All industries that are prioritised can readily request for financial assistance, such as loans that the banks are compelled to grant at a lower interest rate.

Agriculture (including microfinancing groups like SHGs, JLGs, individual farmers, and other institutions dedicated to people working in the sector), micro, small, and medium-sized enterprises (MSMEs) and SSIs, educational and small-scale industrial loans, housing loans, and other microcredit finances fall under the policy’s priority sectors.

Banks can only issue PSL certificates (PSLCs) to the degree that they are permitted to lend in a given sector when they exceed their PSL targets and need additional funding to raise money for the priority sectors. On the e-Kuber platform run by RBI, these certificates can be traded.

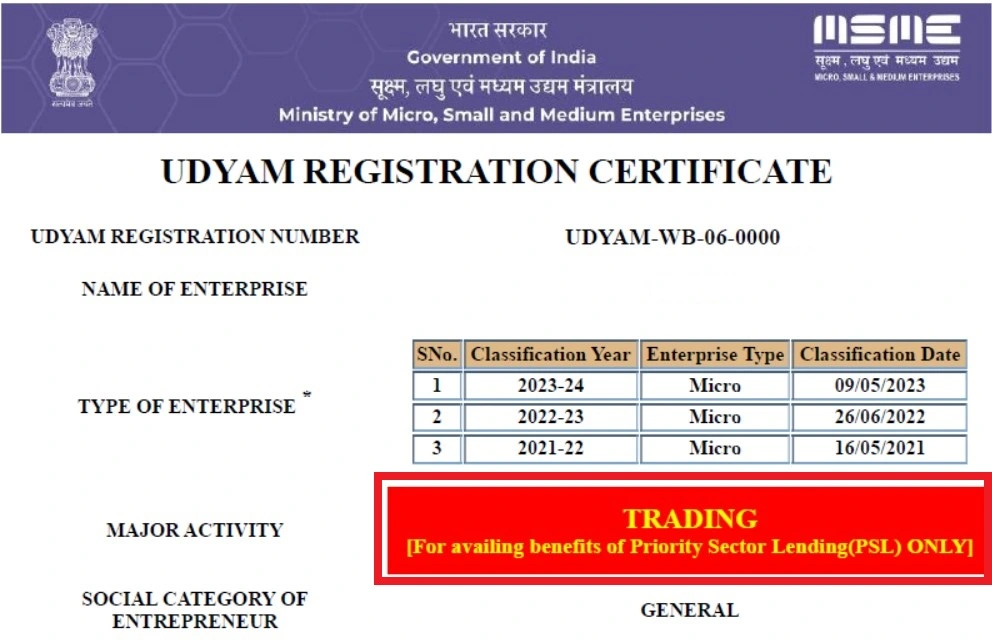

What is For Availing Benefits of Priority Sector Lending (PSL) Only on Udyam Registration Certificate?

The MSMEs are significant, and the NDA administration believes that supporting MSMEs will help the Indian economy thrive. The government has reinstated the ability for dealers to register as MSMEs, which was previously restricted to manufacturers and service providers (see RBI announcement here). Making traders eligible to register as MSMEs will enable them to benefit from the financial aid offered to MSMEs.

MSME in India

According to reports, MSME is India’s second-largest employer after the agricultural sector. 11 crore people are reportedly employed by it. 48 percent of exports are made up of the 30 percent GDP sharing.

History of traders under MSME category

According to the MSME Development Act of 2006, traders qualified for the MSME category. 2017 saw the removal of traders off the MSME list by Centre, who made the case that they neither engage in manufacturing nor offer any services. The Make in India project was given top emphasis at the time. The government has reinstated the ability for dealers to register under the MSME category, as they are now the group most affected by the COVID-19 pandemic.

Impact on Traders

Pandemic-affected merchants will be able to reopen for business. They must register as an MSME in order to be eligible to apply for all financial aid accessible to the MSME sector. The Traders Association is happy with the central government’s actions.

Effect on the MSME’s existing manufacturing and service industries

Government funds for MSMEs are scarce. In already-existing MSME’s, there is already fierce rivalry for loans. The completion for loans will become even more difficult with the inclusion of 2.5 crore merchants. Due to their lower risk character, which may have an effect on the current MSMEs, banks will always give precedence to traders over manufacturing units when clearing loans.

How to Register as MSME as Trader

However, benefits to retail and wholesale trade MSMEs are limited to priority sector credit only. MSME Registration can be obtained on the udyam registration portal.

The registration process for trader on udyam portal is very simple and easy.

Step 1: Visit the udyam registration portal

Step 2: Fill out all the details of your trading business on the udyam application form.

Step 3: Make the online payment for udyam registration service fees.

Step 4: The registration executive will verify all your application filled details and start the process.

Step 5: Your udyam certificate will delivered to your registered email address.

Note: During process you have to share the OTP of udyam aadhar registration process.

What benefit will the traders get as MSMEs

The MSME sector is considered a priority sector for loans. The PSL objective for regional rural banks and small finance banks has been set at 75% of the overall lending, while commercial banks are required to extend 40% of their total lending to the priority sector.

Due to their inclusion in the MSME sector, traders now qualify for priority sector lending (PSL). MSMEs who self-certify their existence by registering on the government website are entitled for a wide range of perks, including a rebate on bank loan interest rates, an exemption from direct tax regulations, and a reduction in electricity bills, among others.

Importance of Priority Sector Lending

Promoting Inclusive Growth

Priority Sector Lending plays a pivotal role in promoting inclusive growth by providing financial support to individuals and sectors that have limited access to credit. It aims to bridge the gap between different sections of society and foster economic opportunities for all. By directing funds to priority sectors, PSL helps in reducing income disparities and creating a more equitable society.

Fostering Economic Development

PSL acts as a catalyst for economic development by channelizing credit towards sectors that have the potential to contribute significantly to the overall growth of the economy. By supporting key sectors such as agriculture and MSMEs, PSL encourages entrepreneurship, job creation, and innovation, which are essential for sustainable development.

Categories of Priority Sector Lending

The categories under priority sector are as follows:

- Agriculture

- Micro, Small and Medium Enterprises

- Export Credit

- Education

- Housing

- Social Infrastructure

- Renewable Energy

- Others

Agriculture

Agriculture is one of the primary sectors targeted under Priority Sector Lending. Farmers and agricultural activities are provided with access to credit, enabling them to invest in modern farming techniques, purchase machinery, and improve productivity. This sector plays a vital role in ensuring food security and reducing rural poverty.

Micro, Small, and Medium Enterprises (MSMEs)

MSMEs are the backbone of the Indian economy, contributing significantly to employment generation and industrial output. Priority Sector Lending supports MSMEs by providing them with affordable credit for working capital requirements, machinery purchase, technology upgradation, and expansion. This enables MSMEs to thrive and contribute to the country’s economic growth.

Export Credit

To encourage exports and boost the country’s foreign exchange earnings, PSL also includes export credit as a priority sector. Banks extend credit to exporters for working capital, pre-shipment and post-shipment financing, and other export-related activities. This facilitates international trade and supports the growth of the export sector.

Education

Recognizing the importance of education for socio-economic development, PSL includes the education sector as a priority sector. It aims to make education accessible to all by providing affordable credit for educational institutions, student loans, skill development programs, and infrastructure development in the education sector.

Housing

The housing sector is crucial for providing shelter and improving living conditions. PSL ensures that individuals from economically weaker sections and low-income groups have access to credit for affordable housing. This promotes inclusive urban development and addresses the housing needs of the marginalized sections of society.

Social Infrastructure

Bank loans to the social infrastructure sector are eligible for priority sector designation if they fall within the limits listed below.

Bank loans up to a limit of 10 crore per borrower for constructing healthcare facilities, including those under “Ayushman Bharat” in Tier II to Tier VI centres, and up to a limit of 5 crore per borrower for setting up schools, drinking water facilities, and sanitation facilities, including construction/refurbishment of household toilets and water improvements at the household level, etc. The aforementioned restrictions only apply to UCBs in centres with a population of under one lakh.

Bank loans to MFIs are given pursuant to the requirements outlined in paragraph 21 of these Master Directions for on-lending to individuals and members of SHGs/JLGs for water and sanitation infrastructure.

Not relevant to RRBs, UCBs, or SFBs.

Renewable Energy

Priority Sector classification is available for bank loans up to a maximum of Rs. 30 crore made to borrowers for projects like solar power generation, biomass power generation, wind power generation, micro-hydel plants, and non-conventional energy based public utilities, such as street lighting systems and remote village electrification, among others. The maximum loan amount for individual families will be Rs. 10 lakh per borrower.

Others

According to the established limitations, the following loans qualify for priority sector classification:

Loans made directly by banks to people and individual SHG/JLG members who meet the requirements outlined in the March 14, 2022, Master Direction on Regulatory Framework for Microfinance Loans Directions.

Banks may grant SHG/JLG loans of up to 2.00 lakh for purposes other than agricultural or MSME, such as addressing social needs, building or repairing a home, building a bathroom, or engaging in any other viable SHG-initiated activity.

Loans to indigent people (apart from indigent farmers who are owed money by non-institutional lenders) that do not exceed Rs. 1 lakh per borrower in order to prepay such debt.

Loans approved to State Sponsored Organisations for Scheduled Castes/Scheduled Tribes for the express aim of acquiring and supplying inputs, and/or marketing the products produced by the organisations’ beneficiaries.

Loans to Start-ups that are involved in activities other than agriculture or MSME up to 50 crore INR, as defined by the Ministry of Commerce and Industry, Government of India.

Phone No: +919347286790

Call us if you facing any problem while udyog aadhar udyam registration.

Whatsapp No: +919347286790

Benefits of Priority Sector Lending

Access to Credit for Marginalized Sections

One of the primary benefits of Priority Sector Lending is the increased access to credit for marginalized sections of society. This includes farmers, small businesses, women entrepreneurs, and individuals from low-income groups. PSL ensures that these sections, which may have limited collateral or credit history, can access loans and financial services, thereby empowering them to improve their livelihoods.

Encouraging Entrepreneurship and Job Creation

By supporting sectors such as MSMEs, Priority Sector Lending encourages entrepreneurship and facilitates job creation. Accessible and affordable credit enables aspiring entrepreneurs to establish and expand their businesses, leading to increased employment opportunities. This helps in reducing unemployment rates and driving economic growth.

Strengthening Rural and Agricultural Sectors

A significant portion of the Indian population relies on agriculture for their livelihoods. Priority Sector Lending provides essential financial support to the agriculture sector, ensuring that farmers have access to credit for farming activities, modernization, and investment in allied sectors such as livestock and fisheries. This strengthens the rural economy and contributes to food security.

Supporting Education and Skill Development

Priority Sector Lending recognizes the importance of education in shaping the future of the nation. By providing credit to educational institutions and supporting skill development programs, PSL facilitates access to quality education and enhances employability. This helps in nurturing a skilled workforce and contributes to overall socio-economic development.

Government Initiatives and Regulations for PSL

The Government of India, in coordination with the Reserve Bank of India (RBI), has implemented various initiatives and regulations to ensure the effective implementation of Priority Sector Lending. These include:

Priority Sector Lending Targets

The RBI sets specific targets for banks to achieve in terms of lending to the priority sectors. These targets are periodically reviewed and revised to align with the changing needs of the economy. Banks are required to meet these targets and report their compliance to the RBI.

Priority Sector Lending Certificates (PSLCs)

To encourage efficient allocation of funds and promote flexibility, the RBI introduced Priority Sector Lending Certificates (PSLCs). Banks that exceed their priority sector lending targets can sell the excess lending certificates to other banks that may fall short of their targets. This mechanism helps in optimizing the allocation of funds and ensures that priority sectors receive adequate credit support.

Challenges and Criticisms of Priority Sector Lending

While Priority Sector Lending has several benefits, it also faces challenges and criticisms that need to be addressed for effective implementation. Some of these challenges include:

Lack of Proper Implementation and Monitoring

One of the key challenges is the lack of proper implementation and monitoring of Priority Sector Lending guidelines. There have been instances where banks have not complied with the mandated targets or have misreported their lending. Strengthening the monitoring mechanisms and ensuring strict compliance can address this challenge.

Misallocation of Funds

There have been concerns regarding the misallocation of funds under Priority Sector Lending. It is essential to ensure that the funds reach the intended beneficiaries and are utilized effectively for the development of the priority sectors. Regular audits and evaluations can help identify and rectify any misallocation of funds.

Need for Effective Risk Management

Providing credit to certain sectors, especially those with higher risk profiles, can pose challenges in terms of credit quality and repayment. Banks need to implement robust risk management frameworks to mitigate potential risks associated with priority sector lending. This includes thorough assessment of borrowers’ creditworthiness, monitoring loan performance, and proactive measures to address non-performing assets.

Conclusion

Priority Sector Lending (PSL) is a vital mechanism that aims to foster inclusive growth and ensure equitable access to financial services. By directing credit towards sectors such as agriculture, MSMEs, education, housing, and export, PSL plays a significant role in promoting economic development, reducing disparities, and supporting key sectors. It is crucial for banks and financial institutions to effectively implement PSL guidelines, monitor lending activities, and address challenges to maximize the benefits of priority sector lending for individuals and the overall economy.

Priority Sector Lending (PSL) highlights

The RBI planned to direct cash into the startup industry in 2020.

Initially, only public sector banks had to concentrate on the growth of the designated priority industries; however, today, private and international banks are also expected to offer necessary support and financing.

The trading of PSLCs resembles that of the money market, where issuing these certificates will assist banks in raising capital. Through this mechanism, banks with excess cash may receive incentives, and banks with a liquidity shortage may obtain short-term financing.

Phone No: +919347286790

Call us if you facing any problem while udyog aadhar udyam registration.

Whatsapp No: +919347286790

Frequently Asked Questions (FAQs)

What is the role of banks in priority sector lending?

Banks play a crucial role in priority sector lending by allocating a certain percentage of their lending to identified priority sectors such as agriculture, MSMEs, education, and housing.

How does priority sector lending contribute to financial inclusion?

Priority sector lending ensures that individuals and sectors with limited access to credit, such as farmers and small businesses, can avail themselves of financial services and participate in economic activities, promoting financial inclusion.

Are there any penalties for non-compliance with priority sector lending targets?

Yes, banks that fail to meet the priority sector lending targets set by the RBI may face penalties or restrictions on certain banking activities.

Can non-banking financial companies (NBFCs) participate in priority sector lending?

Yes, NBFCs are also encouraged to participate in priority sector lending by extending credit to the identified priority sectors. However, they have specific guidelines to follow.

How can individuals and organizations benefit from priority sector lending?

Individuals and organizations can benefit from priority sector lending by accessing affordable credit for various purposes such as farming, starting businesses, education, housing, and export-related activities.

Follow us on Google News