Many Indian business owners registered their MSME years ago under Udyog Aadhaar (UAM). But even in 2026, a large number of businesses are still running without completing the UAM to Udyam migration.

If you are one of them, this article is important for you.

The Government of India has made it very clear — Udyog Aadhaar is no longer valid. Only Udyam Registration Certificate is accepted for MSME benefits in 2026.

Let us understand what happens if you do not migrate.

What Is UAM to Udyam Migration?

Udyog Aadhaar (UAM) was the old MSME registration system.

In July 2020, the government launched Udyam Registration and asked all UAM holders to migrate.

Migration means:

Your old UAM data is shifted to the Udyam portal

You get a new Udyam Registration Number (URN)

Your business stays active as an MSME

If migration is not done, your MSME status is treated as inactive.

👉 You can get help for migration here:

https://udyamregistrationform.com/

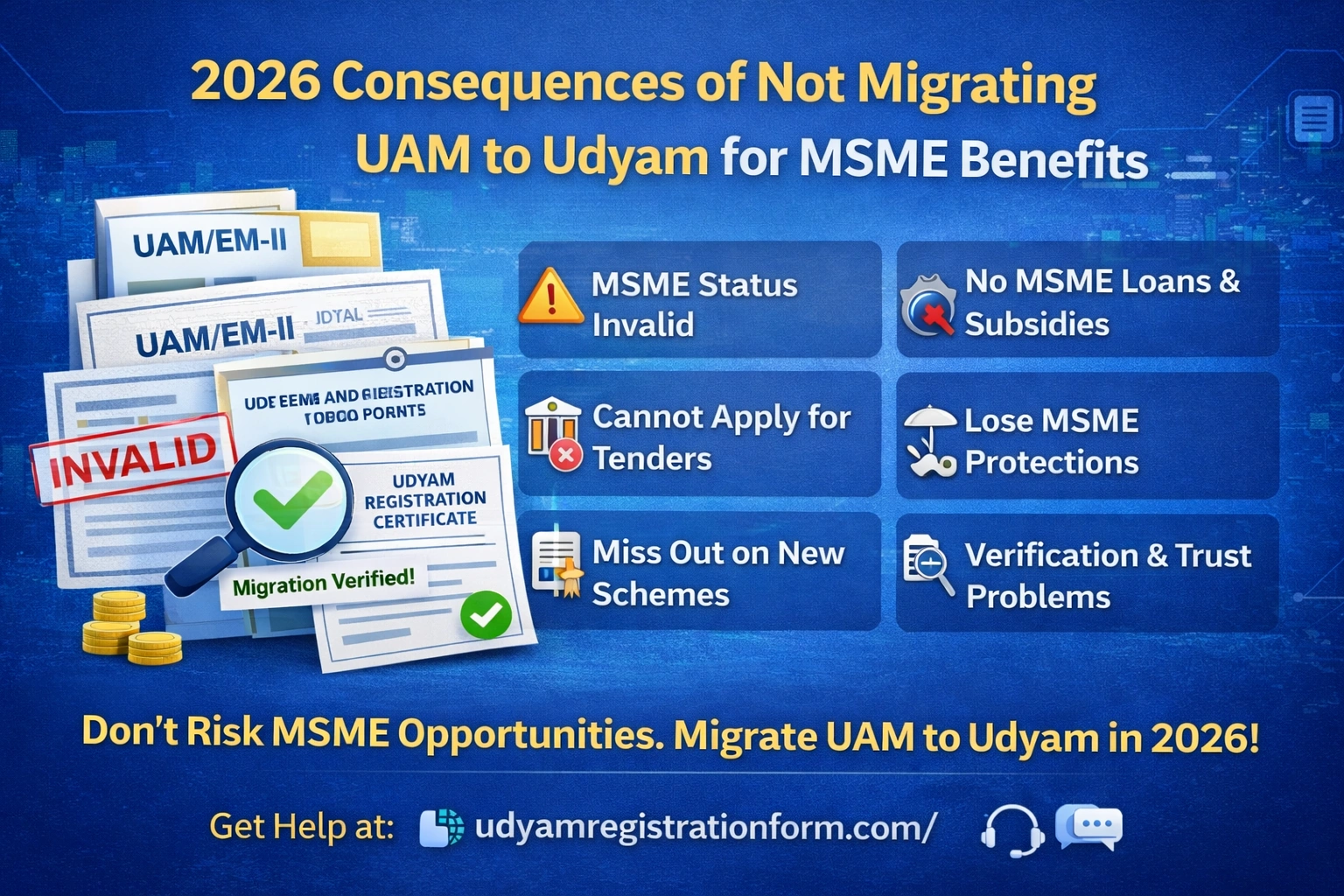

Consequences of Not Migrating UAM to Udyam in 2026

1. MSME Status Becomes Invalid

In 2026, Udyog Aadhaar has zero legal value.

If your business is still on UAM:

You are not considered an MSME

Your certificate will not work anywhere

2. Bank Loans and Subsidies May Stop

Banks now accept only Udyam certificates.

If UAM is not migrated:

MSME loans may be rejected

Interest subsidy benefits may stop

Credit Guarantee Scheme benefits may not apply

This affects both existing loans and new loan applications.

3. You Cannot Apply for Government Tenders

Most central and state government tenders ask for:

Valid Udyam Registration Number

Without migration:

Your business becomes ineligible for MSME tenders

EMD exemption benefits are lost

4. GST, Income Tax & MSME Data Mismatch

Udyam is linked with:

PAN

GST

Income Tax

If you still have UAM:

Data mismatch issues can arise

Notices or clarification requests may come

Your MSME classification may not update automatically

5. Loss of MSME Protection Benefits

MSME businesses enjoy protections like:

Delayed payment protection

Legal support under MSME Act

Without Udyam:

You cannot file MSME delayed payment cases

Big buyers may delay payments without fear

6. No Access to New MSME Schemes in 2026

In 2026, all new MSME schemes are available only through Udyam database.

No migration means:

No new subsidies

No technology upgradation schemes

No export or skill development benefits

7. Problems During Business Verification

Many companies now verify vendors through Udyam portal.

If your business is still on UAM:

Clients may reject onboarding

Vendor verification may fail

Trust issues may arise

Is There Any Penalty for Not Migrating?

There is no direct fine, but the financial loss is much bigger:

Lost loans

Missed tenders

Lost government benefits

That itself is a big penalty for any small business.

Can You Still Migrate UAM to Udyam in 2026?

Yes, migration is still possible if:

Your Aadhaar is active

Mobile number is linked

PAN details are correct

However, many business owners face:

OTP issues

Data mismatch

UAM not found errors

👉 In such cases, you can take professional help from

https://udyamregistrationform.com/

They assist with UAM to Udyam migration, correction, and verification.

Final Advice for Indian Business Owners

If you are still using Udyog Aadhaar, do not delay anymore.

In 2026:

Only Udyam = Valid MSME

UAM is history

Migrating today can save your business from:

Loan rejection

Legal issues

Missed opportunities