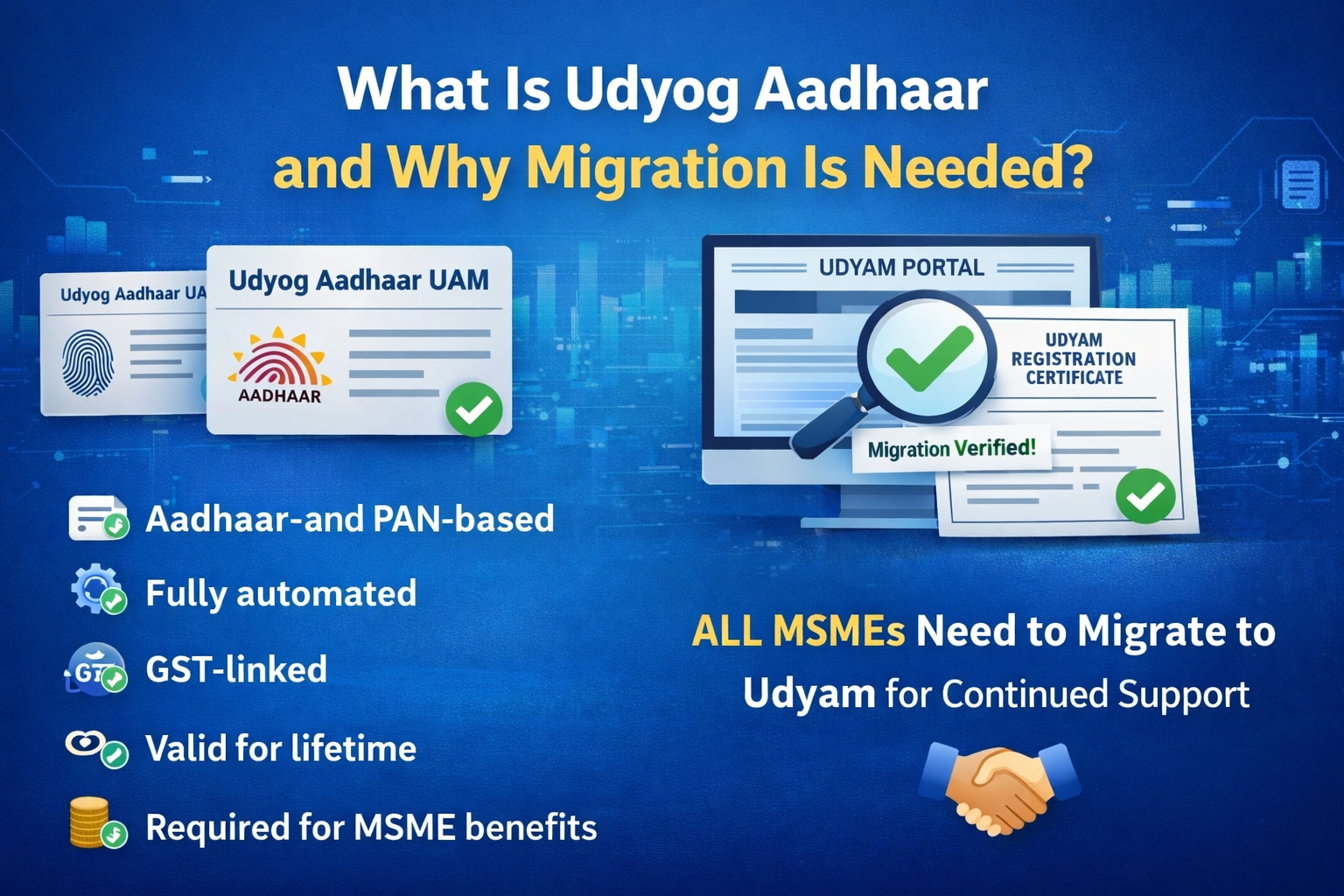

Udyog Aadhaar was the old MSME registration system. It gave small businesses a 12-digit UAM number using basic details like Aadhaar, PAN, and business info.

However, it wasn’t fully reliable and didn’t connect well with government databases. That’s why the Udyam Registration system was introduced. Udyam is:

Aadhaar- and PAN-based

Fully automated

Linked with GST

Valid for a lifetime

Required to get MSME schemes, subsidies, and loans

All MSMEs need to migrate to Udyam to continue enjoying government support.

Who Needs to Migrate MSME Registration in 2026?

You need to migrate if:

You have an old Udyog Aadhaar (UAM) number

Your business is still running

You want access to MSME benefits like subsidies, loans, or ISO reimbursement

You need a valid MSME certificate for tenders, trade licenses, or exports

If you don’t migrate, your old UAM number will no longer be valid.

Migrate Old MSME Udyog Aadhaar (UAM) to Udyam

Fill out this application form for migration of old MSME Udyog Aadhar (UAM) to Udyam Registration certificate process

Documents Needed for Migration form Udyog to Udyam in 2026 process

Before starting migration, keep these ready:

Aadhaar of the business owner

PAN of the business owner or company

Udyog Aadhaar Number (UAM)

GSTIN (if registered under GST)

Business info (type, address, bank details)

Investment and turnover details (auto-fetched for GST holders)

Having these ready makes the process faster.

Benefits of Migrating to Udyam in 2026

After migration, your business gets:

Lifetime-valid MSME certificate

Faster approvals for bank loans

Lower interest rates under CGTMSE

Eligibility for subsidies and incentives

Priority sector lending benefits

Protection against delayed payments

Easier participation in government tenders

Access to MSME grievance and support systems

Migration is crucial for long-term growth.

Step-by-Step Guide for Udyog Aadhaar Migration in 2026

Step 1: Visit Udyam Registration Portal

Go to the official website of Udyam Portal

Step 2: Select Migration Option

Choose “For those having Udyog Aadhaar (UAM)” on the homepage.

Step 3: Enter UAM and Mobile Number

Provide your UAM number and the mobile number linked to it. You’ll get an OTP.

Step 4: Verify With OTP

Enter the OTP received. If your mobile number is inactive, update it or use Aadhaar OTP verification.

Step 5: Enter Aadhaar and PAN Details

Provide the Aadhaar and PAN of the owner or authorized person. PAN verification is mandatory.

Step 6: Fill in Business Details

Confirm or update:

Business name

Type of organization

Business activity (manufacturing/service)

NIC code

Address and bank details

Employee count

Make sure details match your GST and tax records.

Step 7: Add Investment and Turnover

The portal fetches these automatically from GST or Income Tax records. Businesses not under GST can enter details manually.

Step 8: Submit and Get Udyam Certificate

After submitting, you’ll get:

A 16-digit Udyam Registration Number (URN)

A downloadable MSME certificate valid for lifetime

Common Issues During Migration

Old Mobile Number – You may not get OTP if the number is inactive.

PAN & Aadhaar Mismatch – Make sure names, DOB, and other details match.

GST Linking Errors – GSTIN must match PAN & Aadhaar.

Multiple UAM Numbers – Link and migrate all UAM numbers carefully.

How to Check Migration Status

Check online using:

Udyam Registration Number (URN)

Registered mobile number

Updating Details After Migration

Update your business info if:

Business address changes

New activities are added

GST status changes

More employees are hired

The portal allows unlimited free updates.

Why You Should Migrate Before Applying for MSME Benefits

Banks and government departments now require Udyam Registration Certificate for benefits like:

Mudra loans

SIDBI schemes

NSIC subsidies

Tender exemptions

ISO reimbursement

Electricity concessions

Without migration, you may lose eligibility.

Final Thoughts

Migrating from Udyog Aadhaar to Udyam is easy, online, and quick. Completing migration ensures your business:

Remains recognized under MSME rules

Gets access to government benefits

Receives a lifetime-valid MSME certificate

If you’re still using an old UAM number, now is the time to migrate to Udyam and secure your benefits.